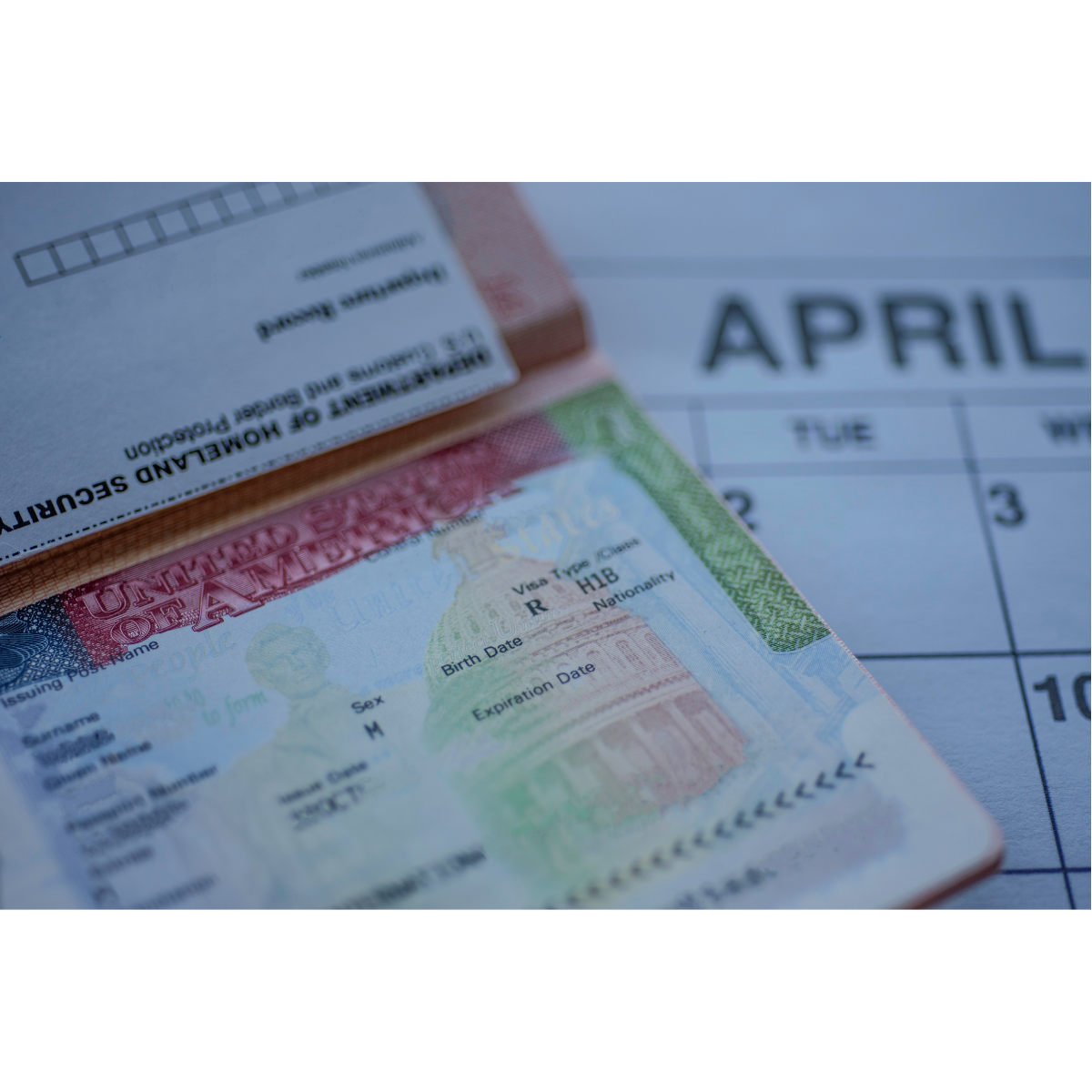

For over two decades, the H-1B “price tag” was a manageable administrative cost. That changed on September 21, 2025. With the new $100,000 supplemental fee now in full effect for the 2026-2027 cap season, HR professionals are no longer just talent scouts—they are high-stakes budget managers.

But here is the detail many are missing: The fee isn’t universal. It is a “tariff on entry,” not a blanket tax on the visa itself.

The Great Divide: Consular vs. Change of Status

The $100,000 surcharge is specifically designed to target the “importation” of labor from abroad. To navigate this, HR must distinguish between two primary filing paths.

First, there is Consular Notification. This occurs when you hire a candidate currently residing outside the U.S. Because these individuals must visit a U.S. Embassy or Consulate to receive their visa stamp before entering the country, they trigger the full surcharge.

The second path is the Change of Status (COS). This is the “safe harbor” for many U.S. employers. If your candidate is already in the U.S. on a valid visa—such as an F-1 student on OPT or an L-1 intra-company transferee—you are simply asking USCIS to change their internal designation. In these cases, the $100,000 fee does not apply. This makes domestic international talent, particularly recent graduates from U.S. universities, the most “cost-effective” recruits in the current market.

The “Hidden” Risks for HR

The danger for HR professionals lies in the “accidental trigger.” If an employee is currently in the U.S. and you file for a Change of Status, they must remain in the country while the petition is pending. If that employee travels abroad for a family emergency or a business trip before approval, the petition automatically converts to Consular Notification. In the eyes of the government, you have just moved from a “free” status change to a $100,000 liability. Tightening your internal travel policies for visa-dependent staff is no longer a suggestion; it is a financial necessity.

A Budgeting Checklist for HR Teams

As you finalize your 2026 international hire headcount, keep these three pillars in consideration:

-

Prioritize “Domestic” International Talent: Focus your recruitment on candidates already holding U.S. work authorization (OPT/STEM extensions) to bypass the surcharge entirely.

-

Verify Pay.gov Access: The $100,000 must be paid upfront via Pay.gov. Ensure your finance team has authorized these high-limit transactions well before the March lottery deadline.

-

Audit Your “Premium” Needs (optional): Opting to pay the $2,965 Premium Processing fee can get you a definitive “Yes” or “No” on your $100,000 investment within 15 days.

The 2026 landscape is daunting, but with a strategic focus on where and how you hire, you can maintain a global talent edge.

Work with an Attorney

Working with an attorney shifts the burden of “staying current” from your plate to ours. In a year where a single clerical error can cost your company $100,000 and a two-year debarment from hiring, legal counsel is an insurance policy.

Reach out to our experts today.